5 Key Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do's for Success in the Private Credit Job Market

Develop Specialized Skills and Expertise

The private credit job market demands a unique blend of hard and soft skills. To stand out, focus on developing expertise in areas highly sought after by employers.

- Financial Modeling: Proficiency in building complex financial models is crucial for analyzing investment opportunities.

- Credit Analysis: A deep understanding of credit risk assessment, including quantitative and qualitative analysis, is essential.

- Underwriting: Experience in evaluating loan applications and determining creditworthiness is highly valued.

- Legal Documentation in Private Credit: Familiarity with loan agreements, security documents, and other legal aspects is vital.

- Portfolio Management: Skills in monitoring and managing a portfolio of private credit investments are essential for senior roles.

- Debt Restructuring: Experience in negotiating and restructuring distressed debt can significantly enhance your marketability.

- Distressed Debt Investing: Expertise in identifying and investing in undervalued or troubled debt is highly specialized and in demand.

Beyond technical skills, cultivate strong soft skills:

- Communication: Clearly and concisely articulate complex financial information to both technical and non-technical audiences.

- Teamwork: Collaborate effectively with colleagues across different departments and functions.

- Negotiation: Successfully negotiate terms and conditions with borrowers and other stakeholders.

Consider pursuing relevant certifications to further enhance your credentials:

- CFA (Chartered Financial Analyst): A globally recognized designation for investment professionals.

- CAIA (Chartered Alternative Investment Analyst): Specializes in alternative investments, including private credit.

Network Strategically

Networking is paramount in the private credit job market. Building strong relationships with key players can unlock unadvertised opportunities and provide invaluable insights.

- Attend Industry Conferences: Participate in events like the SuperReturn conferences, Loan Syndications & Trading (LST) conferences, and industry-specific events organized by associations like the Loan Market Association (LMA).

- Join Relevant Professional Organizations: Become a member of organizations such as the Alternative Credit Council (ACC), the American Securitization Forum (ASF), or regional private credit associations.

- Leverage LinkedIn Effectively: Craft a compelling profile, actively engage in relevant groups, and personalize connection requests to industry professionals.

Proactive networking can significantly increase your chances of securing a private credit role. Don't underestimate the power of informational interviews and building genuine connections.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They must effectively showcase your skills and experience to potential employers in the competitive private credit job market.

- Tailor Your Application: Customize your resume and cover letter for each specific job application, highlighting relevant skills and experience.

- Quantify Your Achievements: Use numbers and data to demonstrate the impact of your contributions in previous roles.

- Showcase Relevant Keywords: Incorporate keywords from the job description to ensure your application is easily identified by applicant tracking systems (ATS).

Use action verbs, a clear and concise format, and highlight your most impressive achievements. For example, instead of "Managed a portfolio of loans," try "Managed a $500 million portfolio of private credit loans, resulting in a 15% increase in portfolio yield."

Don'ts for Success in the Private Credit Job Market

Neglect Networking and Relationship Building

Failing to network actively can significantly hinder your job search. You'll miss out on hidden opportunities and limit your exposure to industry leaders. Proactive networking is crucial for securing a private credit role.

Submit Generic Applications

Submitting generic applications demonstrates a lack of interest and personalization. Employers in the competitive private credit job market appreciate candidates who demonstrate a genuine understanding of their firm and its activities. Tailoring your resume and cover letter to each specific job is essential.

Underestimate the Importance of Due Diligence

Thoroughly research potential employers before applying or interviewing. Understand their investment strategies, recent transactions, and company culture. Demonstrating a deep understanding of the firm during interviews showcases your preparation and interest. Appearing unprepared can significantly reduce your chances of success.

Securing Your Future in the Private Credit Job Market

This article highlighted five key "do's" and "don'ts" for success in the private credit job market. Remember, developing specialized skills, strategically networking, and crafting targeted applications are crucial for standing out from the competition. Mastering these aspects will significantly increase your chances of landing your dream private credit job. Start building your network and honing your skills today – your dream private credit job awaits!

Featured Posts

-

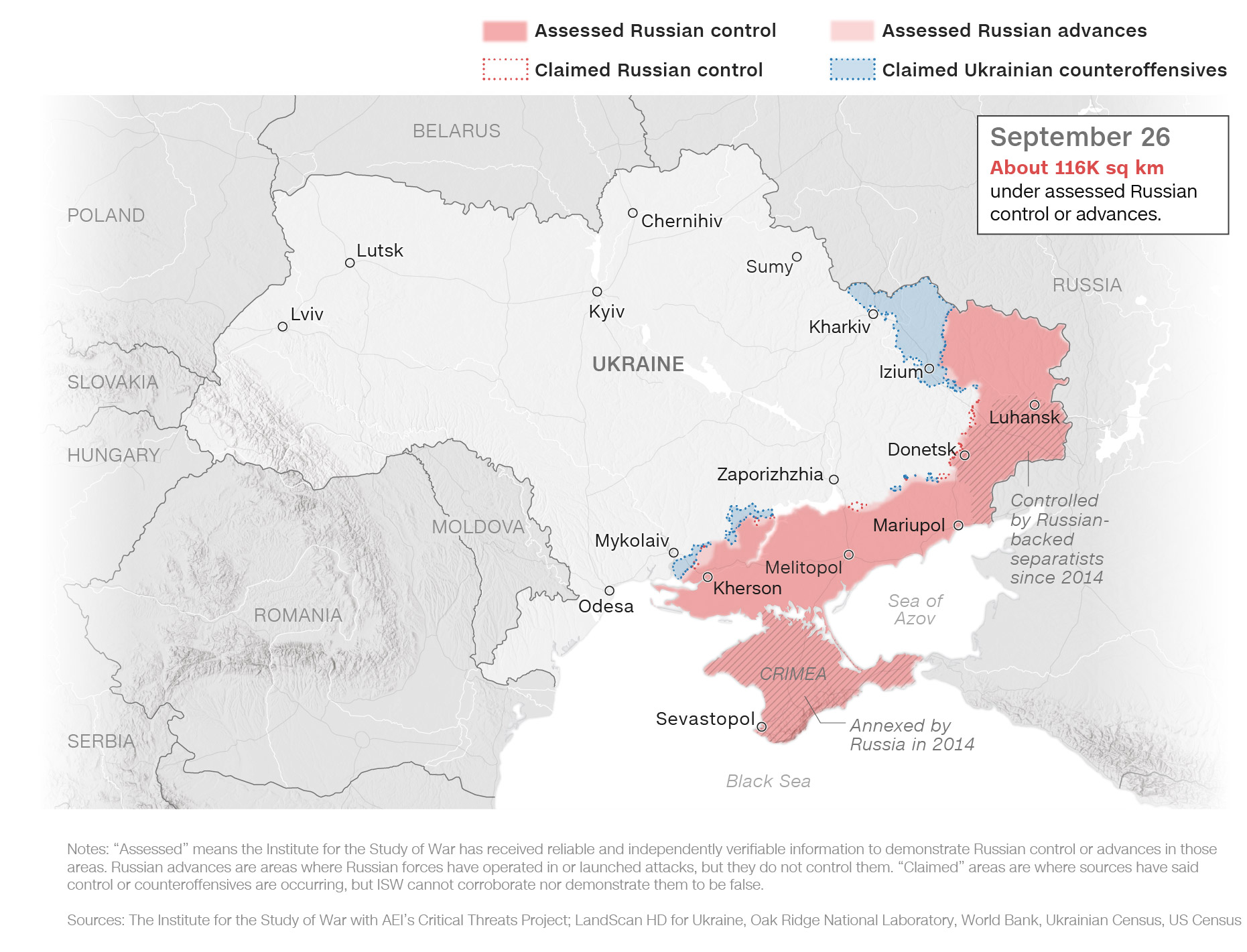

Ukraine Conflict Kyiv Under Pressure To Respond To Trump Plan

Apr 22, 2025

Ukraine Conflict Kyiv Under Pressure To Respond To Trump Plan

Apr 22, 2025 -

Obamacares Fate In The Supreme Court Trumps Role And Rfk Jr S Potential Rise

Apr 22, 2025

Obamacares Fate In The Supreme Court Trumps Role And Rfk Jr S Potential Rise

Apr 22, 2025 -

The Pan Nordic Army A Realistic Assessment Of Swedish And Finnish Contributions

Apr 22, 2025

The Pan Nordic Army A Realistic Assessment Of Swedish And Finnish Contributions

Apr 22, 2025 -

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025

Death Of Pope Francis At 88 A World Mourns

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025